Mindful Money:

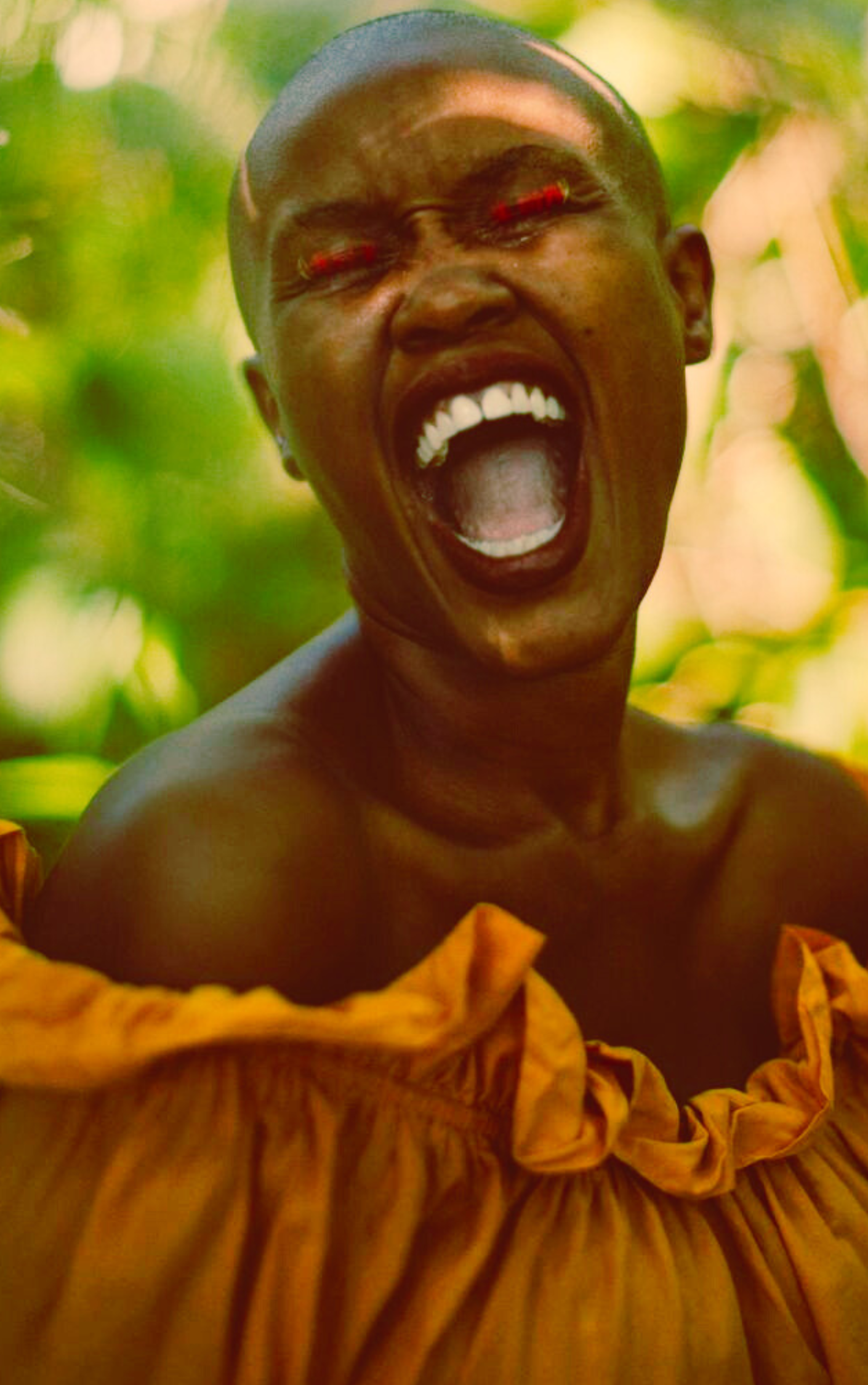

The Ultimate Cure To

Money Anxiety & Toxic Shame.

I’ve seen this before.

Living through apartheid, I witnessed first hand how fear and lies dismantle nations. And now, I see the same tactics resurfacing in America & spreading throughout the world.

Distraction.

Destabilization.

Depression.

Debt.

Destruction.

This isn’t random—it’s a strategy. A relentless campaign to keep you overwhelmed, powerless, and paralyzed.

They want you confused.

Frustrated.

Isolated.

Because a divided society is easier to control.

But once you SEE the pattern_,

you can break free.

The Impact of Money Stress

49% of individuals say that they have lied about their financial situation at least once due to fear of judgment, further contributing to the shame and anxiety associated with money.

When you feel like you’re not measuring up to financial norms or expectations, you may feel compelled to hide your true situation. This can manifest in various ways, such as:

Pretending to be more financially stable than you are, by overstating earnings or exaggerating assets. This is often driven by a fear of being judged as “unsuccessful” or “irresponsible.”

Downplaying financial struggles like debt, job loss, or your inability to afford certain things, in an effort to maintain appearances and avoid feeling "less than" others.

Avoiding certain social situations, such as dinners or outings, because you’re concerned about being unable to contribute or keep up financially.

Source: Bankrate

1 in 5 adults regularly experience financial anxiety, and if you’re one of them, you’re not alone.

The pressure can feel overwhelming, but recognizing these feelings is the first step toward gaining control. Financial anxiety can manifest in various ways:

Constant worry about debt, leading to sleepless nights and a feeling of never being able to get ahead.

Overwhelming fear of overspending, even on essential items, because you're afraid of running out of money.

The fear of not having enough money to cover basic needs, which can make every decision feel like a high-stakes risk.

The emotional burden of trying to make ends meet, causing you to feel stuck and uncertain, no matter how hard you try.

Lying awake at night, overwhelmed by thoughts of bills, debt, or the inability to save for the future, making it hard to feel like you’re in control.

Source: NerdWallet

Sign up for

Mindful Money

UNMASK THE TRUTH BEHIND MONEY SHAME & ANXIETY.

Inside, you’ll discover:

The hidden forces that amplify financial shame and keep you feeling “not enough.”

How comparison, judgment, and societal pressures distort your sense of self-worth based on your financial situation.

Why financial anxiety isn’t your fault — and how to break free from the cycle of fear and guilt.

The path to reclaiming control over your finances, even when it feels like you’re falling behind.

They want you to feel small.

We want you to feel empowered.